Our Mission

Investing in the legacy of those who serve through scholarships

Our Programs

We’re proud to announce a new chapter that focuses on our core mission of providing scholarships for those who serve and those who support them. By realigning our core focus to support military families through scholarships, we can invest more directly in students and increase the impact of every donation. Our 3-year goal: grow our annual scholarship awards from an average of $127,000 to $300,000.

Events

Our fundraising events bring together people united in our mission of investing in the legacy of those who serve through scholarships. Visit our Get Involved page to find out how you can sponsor, attend, or volunteer at our next event!

Scholarships

Get Involved

About Us

Events & News

Events and News

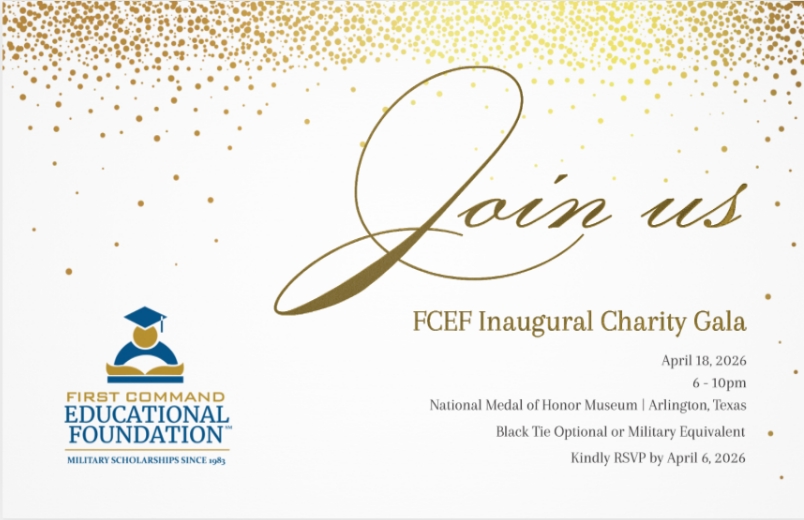

Join our Inaugural Charity Gala April 18, 2026, at the iconic National Medal of Honor Museum in Arlington, Texas!